More and more pet parents are choosing to enroll their dogs in pet insurance. In theory, it seems like a good idea—even veterinarians recommend it! Still, there are skeptics. I know—I was one of them.

Along with many others, I thought that it was simply better to put the money I’d spend on pet insurance aside in a savings account. My thinking was this—if I needed the money for vet bills, it would be there. If I didn’t, I’d have lots of extra money to spend how I please instead of giving it away to some greedy corporation.

Fast forward to today. My goldendoodle, Chewie, is enrolled in pet insurance and we are very happy customers of Healthy Paws Pet Insurance. Not only that, I’m a strong proponent that others should do the same for their dogs.

Wow. I did a complete 180. What changed?

After a ton of number-crunching and more pros-and-cons lists than I care to admit, it came down to a few questions I asked myself. Today, I want to share those same questions with you. I hope it’ll get you thinking and help you make the best choice possible for you and your furry best friend.

Are you willing and able to commit to saving?

We live in a world where saving money isn’t prioritized and often isn’t practical. Think of how many people you know of that have started “travel funds.” It begins with great intentions—slowly saving money to eventually go on a dream vacation. But, how many of these people end up achieving this goal? You guessed it! Almost none.

Life happens. Hot water heaters break, cars get taken to the shop, or people lose their jobs. All of those are legitimate reasons you could use to dip into your pet’s savings account. With 78% of Americans are living paycheck-to-paycheck, good luck having the willpower to put additional money aside and leave it untouched when times get tough.

How soon will you need to spend the money?

Like it or not, we don’t have a crystal ball when it comes to the health of our pets. There isn’t a way to predict if, when, or how often your dog will get injured or ill.

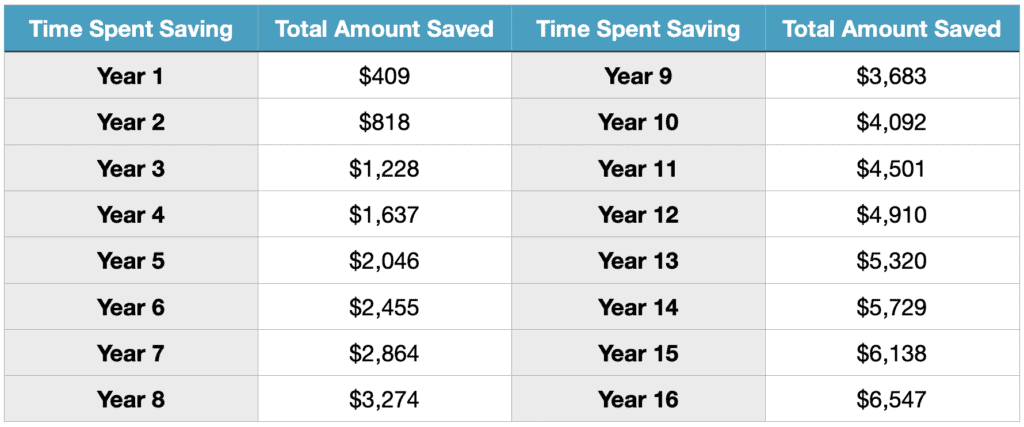

My 4-year-old Goldendoodle, Chewie, is currently enrolled in Healthy Paws Pet Insurance. I spend $34.10 each month for his coverage. What if I decided to opt for saving that money instead of having pet insurance? Let’s take a look at how quickly my money would grow…

Note: This scenario uses the monthly price of my policy. Your price may differ depending on your dog’s age, breed, location, etc.

Let’s say Chewie lives to the ripe old age of 15 years old—that’s 11 years of saving diligently. With $4,500 in the bank, I’d be pretty well-prepared to pay for an emergency vet bill 11 years from now! But what happens if he breaks a leg 6 months from now? Or what if he swallows a toy 2 years from now? Gets cancer 4 years from now?

This is by far the biggest flaw of saving vs. investing in pet insurance. With pet insurance, money is always available to you when you need it. With saving, you better hope nothing bad happens while you build up a nest-egg big enough to pay for it. You also better hope that your dog only ever has one accident or injury during their lifetime. With saving, after your dog has one health issue you have to essentially start from scratch again.

Let’s put this into some context. Here are five examples of real injuries and illnesses that happen to dogs every day. Using our hypothetical savings plan, how long would we have to save until we’re able to pay for each of these?

Bloat (GDV) – A common stomach issue in larger dogs, your dog’s odds of bloat increase 20% every year after the age of 5. While it used to be a death sentence for dogs, now it can be treatable if action is taken soon enough. However, this advance in veterinary technology comes at a cost—specifically $2,509 or 6 years of saving.

Cancer – One in four dogs will get cancer in their lifetime. Are you prepared to foot this bill? Unless you’ve been saving for just over 13 years, for a total of $5,351, you probably aren’t.

Ingestion of a Foreign Object – Think you have a healthy puppy that will beat the odds of getting a major disease? Well, no amount of good genetics will prevent a curious puppy from putting any and all available items in their mouth. How much will this surgery set you back? Try $2,964 or over 7 years of saving.

Cataracts – A common side-effect of getting older, If left untreated your dog will likely go blind. If you don’t want your furry family member living out their golden years in complete darkness it’ll set you back $3,350 or 8 years of saving.

ACL Tear – Does your dog go 110% while playing a game of fetch? If so, you better hope they put the brakes on for the next 13 years or you won’t have enough money to pay the $5,439 to treat an ACL tear. Keep in mind, ACL tears are rarely a one-and-done injury. Once your dog has had one ACL tear, they have a 40% shot of tearing the other ACL shortly after.

These examples aren’t meant to scare you, but rather to show you that expensive injuries and illnesses can happen at ANY time—not just when it’s convenient for you. Simply putting away the money you’d spend on pet insurance into a savings account doesn’t do anything to protect your pet TODAY.

Are you using Normalcy Bias as an excuse?

It’s funny—the people who argue most passionately against purchasing pet insurance are usually those who’ve been fortunate enough to never have had a pet have a major medical expense.

This type of thinking is called a Normalcy Bias. These people assume that because they’ve never seen it happen, or it has never happened to them, that it won’t happen to them in the future. Normalcy Bias causes people to underestimate the possible effects of a disaster.

This ‘logic’ begins to fall apart once you start thinking about it rationally. A prime example of this is something we see on the news every year—hurricanes. People who live in frequent hurricane zones will sometimes refuse to evacuate as they’ve lived through many similar storms before and are were left unharmed. What happens to these people? Well, some live and continue to perpetuate this thinking. Sadly, many others die due to this illogical Normalcy Bias.

Please don’t let your pet suffer the consequences of falling for this common misconception. Numbers don’t lie, and the numbers say that the threat of major veterinary expenses are real:

- 1 in 3 pets will need urgent veterinary care this year.

- Each month, 10% of people with pet insurance will make a claim.

- On average, pet owners pay $425/year in veterinary bills. Keep in mind this figure is actually quite low considering it factors in both cats and fish whose medical costs are significantly less than that of dogs.

Are you thinking about it the wrong way?

Insurance is not an investment—at least in the financial sense. You don’t buy health insurance or homeowner’s insurance to get a return on your investment. So why do we automatically think the goal should be to “make a profit” compared to a savings account when it comes to pet insurance?

Over the course of your dog’s life you may end up paying significantly less because you had pet insurance. You also may end up paying slightly more. Unless you enjoy gambling with your dog’s health, that’s not the point.

The point is that pet insurance is meant to provide financial protection and peace of mind. Imagine knowing that you’ll never have to alter your dog’s care based on what you can afford. Imagine knowing that you’ll never have to decide that your dog’s life is too expensive to save.

THAT is the value of pet insurance.

What’s the solution?

In my mind, the solution is simple. You CAN and SHOULD have both pet insurance AND savings put away for veterinary expenses. The savings account will help you budget for checkups, deductibles, exam fees, and even your monthly pet insurance payment. Your pet insurance policy will provide a financial safety net for the unknown.

At the end of the day, any type of insurance is something you’d rather have and not need, than need and not have. It’s our responsibility as pet parents to anticipate and prepare for the unexpected. Pet insurance, especially when used in alongside a pet savings account, is a simple and convenient way to plan for those unforeseen events.

For that reason, I recommend checking out Healthy Paws Pet Insurance and getting a free online quote. It takes about 5 minutes and there is no obligation whatsoever. They are #1 customer-rated pet insurance company and one of the most affordable, yet comprehensive options.

I take pride in in only recommending products and services I truly believe in and stand by. In fact, I trust Healthy Paws with my own doodle’s pet insurance policy. If you have any questions or need assistance at any point please reach out through our contact page!